Three Steps To Your Best Home Loan

ANSWER A FEW QUESTIONS

Give us some details on the kind of home loan you need and how you’ll use it. We’ll send your request out to our lender network, and within seconds, you’ll see competing offers.

SHOP AND COMPARE

This works just like shopping for a flight. Lenders are competing for your business, which means you get the most competitive offers. No markup from us.

MAY THE BEST HOME LOAN WIN.

We make home loan shopping easy. You can compare offers side by side, talk with home loan officers to haggle, or in many cases, just apply online. Choose the loan that works best for you.

How to pick the best mortgage

Shopping for a mortgage requires you to be a smart consumer. You need to know the ins and outs of the different types of loans available, plus what factors influence your interest rate and the fees you’ll pay.

We’ll cover both of those here.

A quick guide to the different types of loans you can choose from Before you start shopping for mortgages, you’ll want to determine what type of loan and loan program fits your needs the best. This will help you narrow down your choices.

Fixed-rate mortgages

The fixed-rate mortgage is by far the most popular choice for first-time homebuyers, particularly the 30-year fixed rate mortgage. With this loan, your interest rate will never change, providing a stable monthly payment for the life of the loan.

Adjustable-rate mortgages

The adjustable rate mortgage, or ARM, can be a valuable option if you want to save money for a short period of time. Adjustable-rate mortgages include an initial interest rate that is usually lower than a fixed rate. But when that initial period ends in three, five or seven years, the payment will adjust higher depending on current market conditions.

Conventional mortgages

Conventional mortgages are based on rules set by government-sponsored entities Fannie Mae and Freddie Mac. They’re the most common type of home loan because of the flexibility they offer. Down payments can be as low as 3%, though mortgage insurance is required if you make less than 20% down payment. However, PMI can be canceled as your home value goes up, which makes it a popular choice for home buyers. Conventional mortgages can have fixed or adjustable rates.

Government insured loan programs

There are a number of government loan programs available that provide additional options for homebuyers depending on their financial situation and homebuying needs.

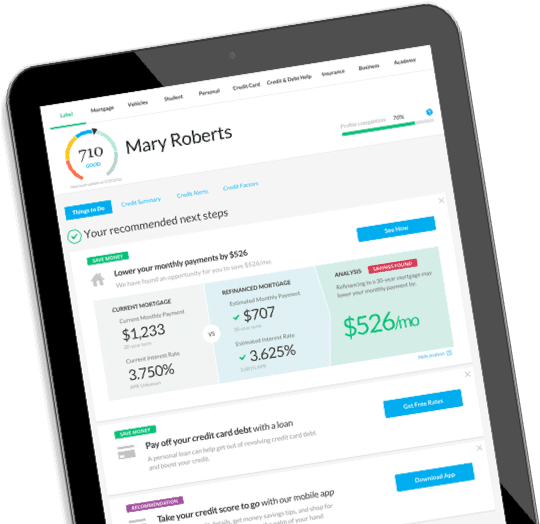

What Does LendingTree Do?

We help you get the best deal possible on your home loans, period. By giving consumers multiple offers from several lenders in a matter of minutes, we make comparison shopping easy. And we all know-when lenders compete for your business, you win!