Start investing in loans quickly and easily!

- It will only take few minutes to open an account for free of charge.

- Instant online money transfer between bank account and service is provided.

- Online identify verification enables you to begin investing already today.

We are offering

- Historical and annual yield has been 7-10%.

- No fees for investing in loans.

- Limited credit loss risk.

- Consumer and business loans.

- Short-term and long-term loans.

- Geographical diversification.

Nordics' leading platform

- Loans funded ove 515 Million €.

- Over 14 000 investors.

- Regulated by Finnish Financial Supervisory Authority.

- Listed on Nasdaq First North Finland.

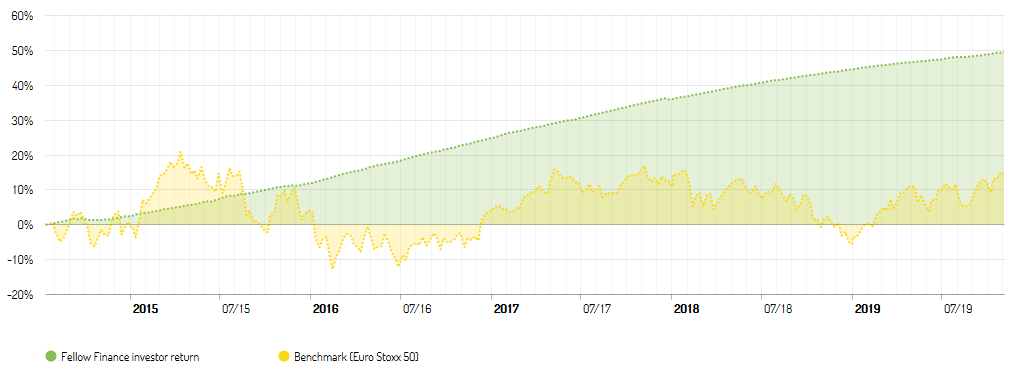

Investor returns

Fellow Finance

The leading marketplace lending platform in Northern Europe for creditworthy consumer and business borrowers and for anybody who wants to gain returns for their spare money.

Registration

Set up your free investment account and set your lending criteria. You can invest manually in loan applications or automate your investment by using Allocator.

Loan contract

A loan contract is automatically signed between you and the borrower when the loan is withdrawn. Fellow Finance manages all the administration between parties involved.

Stable and steady returns

You receive monthly interests and repayments which you can re-invest to receive compound interest. If needed, portfolio can be liquidated on the secondary market.

A new profitable asset class

Consumer and business loans have offered a high annual return for investors. The annual return after credit losses has been around 7-10%. Investing in loans offers you an access to a new asset class. The return on loans does not correlate significantly with the stock or bond markets indicating that loans are a good addition to managing your portfolio.

Investing is for everyone

Are you considering a new alternative investment asset class to diversify your total investment portfolio or are you just starting your journey as an investor? Whether you are looking for a savings instrument or managing a bigger portfolio, Fellow Finance enables you to invest in an asset class earlier unavailable. We have made the investing in consumer loans and business loans easy. We have used over 15 years of our experience in credit risk management and loan investment to build the most advanced marketplace lending platform in Europe. Since our establishment in 2013, we have grown to become the leader in Northern Europe in our field. We are offering now an unique possibility for everybody to invest directly in loans free of charge with limited credit risk.

Become a banker in 2019

By investing in loans, you will have an access to an investment product that has previously been exclusively available for banks. According to the bank earning logic, a bank collects money from depositors at a low deposit rate to lend the same money to borrowers at a higher interest rate. Our platform removes the bank between a saver and a borrower and the saver himself chooses whom and on what terms he wants to lend his spare money. Thus, the saver gets the entire interest from his money without brokerage fees earlier taken by the bank. Why lend money at a low interest rate to a bank if you can now lend it directly at a higher interest rate and no costs?

Credit risk management

Fellow Finance finds and identifies borrowers and assesses their loan applications. Approved application requires that a borrower does not have any earlier payment defaults and the borrower needs to have sufficient monthly disposable income to repay the loan. You choose whom you are willing to lend and on which terms. Our machine learning based credit scoring model has a proven track record that can be observed on our statistics page.

Diversification of porfolio

You can easily diversify investment portfolio in hundreds of loans to reduce credit risk significantly and making it possible to get steady returns with low volatility. You can diversify your loan portfolio geographically in German, Swedish, Danish, Polish and Finnish peer to peer loans as well as Finnish and Swedish business loans and trade receivables. Investing your total capital to at least 100 different loans decreases credit risk. A maximum 1% of the total capital should be invested in one loan within a single loan market. Investing in peer to peer and business loans enables you to diversify your overall investments in to a totally new asset class that does not correlate much with traditional asset classes such as stocks and bonds.

About US

Fellow Finance Plc offers the most advanced marketplace lending platform in Europe. Both individuals and business can find funding for their needs in our platform and investors receive interest for their money lent. This makes us the only platform in eurozone which connects individuals, businesses and investors. Our growth has been rapid since our launch in 2013 and today we are the biggest marketplace lending platform in Northern Europe.

Fellow Finance is a Finnish fintech company founded in 2013 and started operating in 2014. We have grown to be international crowdfunding company and we have listed on the Nasdaq First North Growth Market Finland marketplace. Fellow Finance Plc is an Authorized Payment Institution supervised by the Finnish Financial Supervisory Authority of Finland.